From Spreadsheet to Billing System.

Policivo turns your existing policy data into a fully automated billing platform for independent agencies, brokers, and MGAs — no system migration required.

Everything you need in a modern billing platform

Replace manual spreadsheets and disconnected tools with a single Billing OS that understands carriers, MGAs, brokers and trust accounting.

How payments work

Your money goes directly to your bank account — not Policivo's. Here's exactly how it works.

One-Time Setup

- Sign up as an agency on Policivo

- Go to Settings → Payment Setup

- Click "Connect with Stripe"

- Log into existing Stripe or create new account

- Enter your bank account details

- Your Stripe account is now linked

Send Invoice

- Create an invoice in Policivo

- Download PDF with QR code

- Send via email or mail

- Customer scans QR code

- Sees payment page with amount

- Pays with card or bank transfer

Receive Money

- Stripe processes the payment

- Money goes directly to YOUR bank

- Arrives in 2-3 business days

- Policivo marks invoice as "Paid"

- Full audit trail maintained

- No manual reconciliation needed

Stripe Connect links YOUR Stripe account (with YOUR bank details) to Policivo. Every payment from your customers goes directly to YOUR bank, not Policivo's.

Billing that can improve cash flow

Most insurance businesses don't have a billing problem — they have a cash timing problem.

- Invoices sent, payments arrive late

- Cash stuck in A/R

- Agencies front carrier payments

- No real-time visibility

- Payments collected faster

- Reduced cash float

- Controlled remittance timing

- Live cash flow visibility

Billing shouldn't strain your cash. Policivo can help remove the timing gap.

Start Free TrialEnterprise-grade security for your billing data

Insurance billing involves sensitive financial data and fiduciary responsibility. We take security seriously.

See Policivo in action

Take a visual walkthrough of the platform and see how Policivo transforms your billing operations.

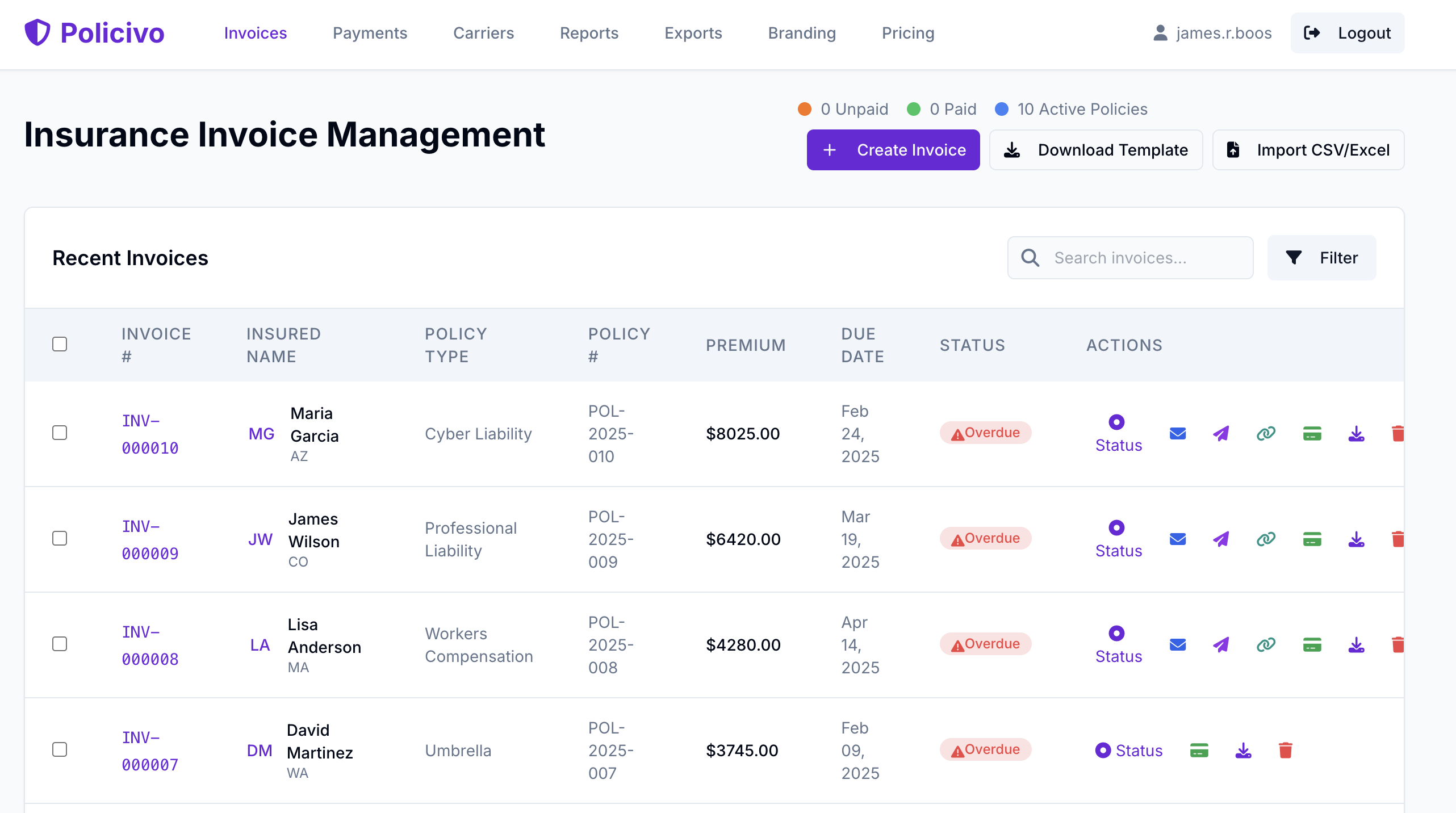

Invoice Management Dashboard

Your central hub for all billing activity. View recent invoices, track payment status, filter by carrier or policy type, and take action with one click. Import policies from Excel or create invoices manually.

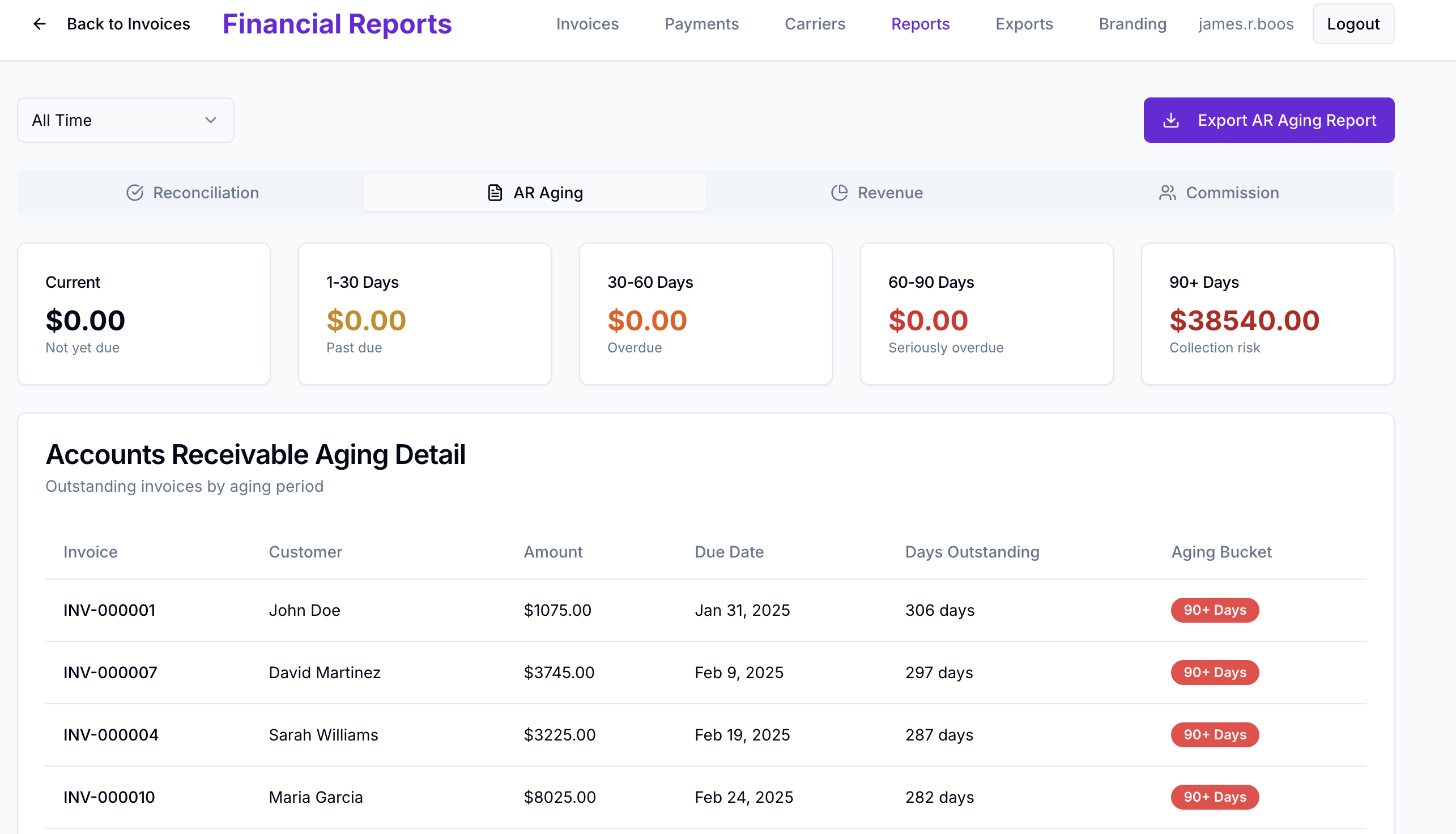

AR Aging Reports

Know exactly what's outstanding and when. The AR Aging report breaks down receivables by aging bucket—current, 30, 60, 90+ days—so you can prioritize collections and spot issues before they become problems.

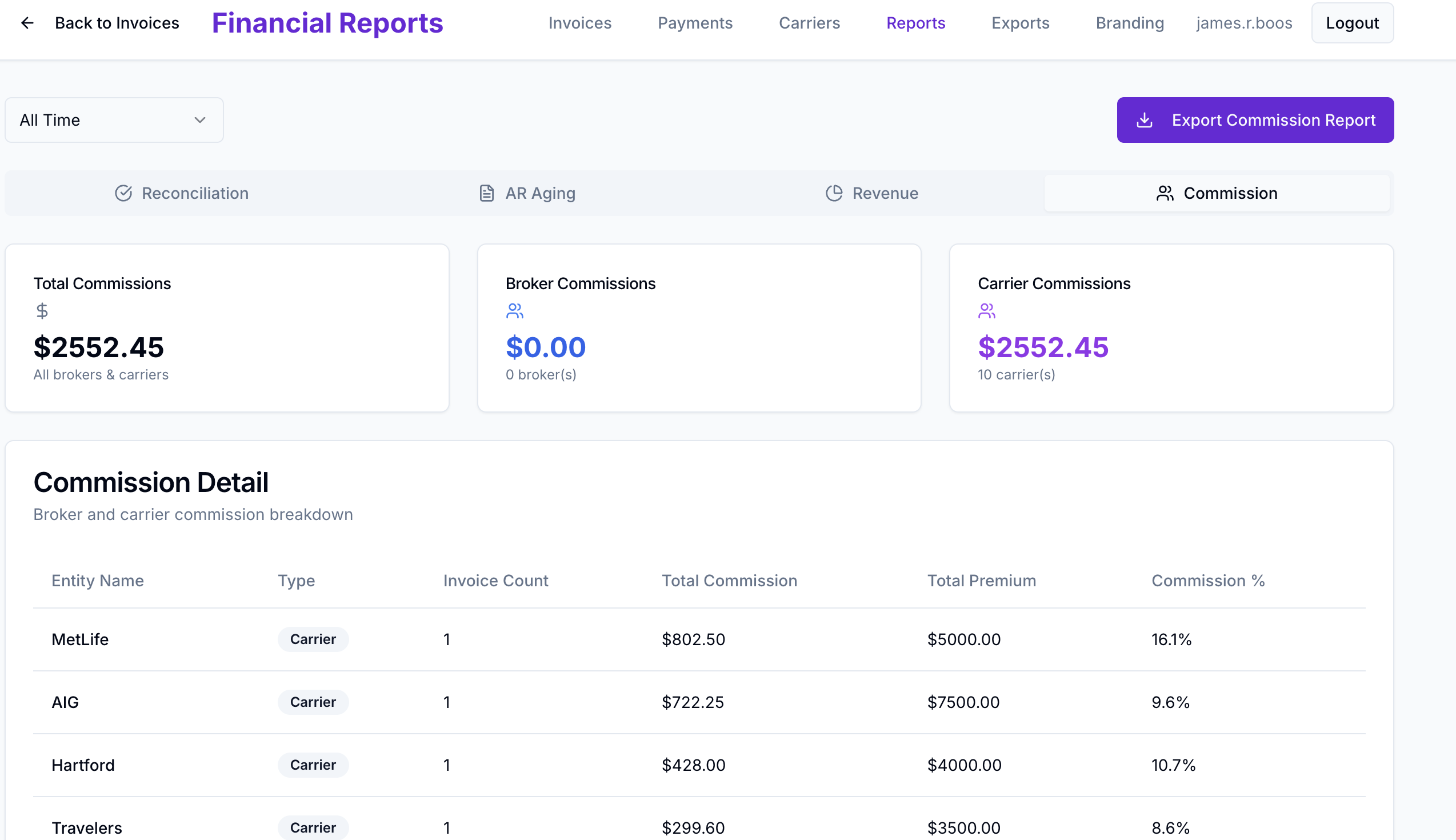

Carrier Remittance Reports

See exactly what you owe each carrier at a glance. Policivo automatically calculates carrier net amounts based on your defined rules, making month-end remittance effortless.

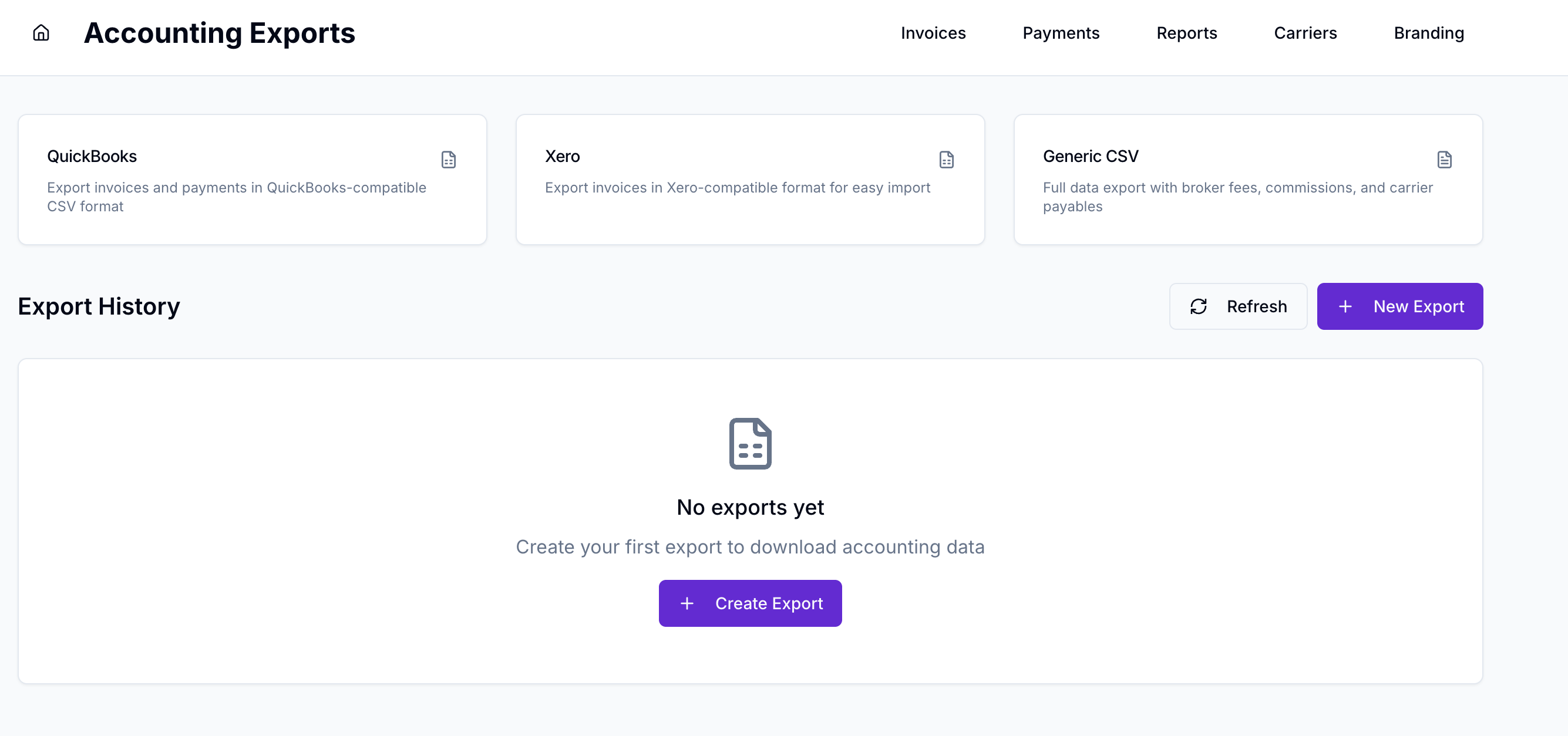

Accounting Exports

Export your data to QuickBooks, Xero, or generic CSV with one click. No manual data entry, no copy-paste errors. Keep your accounting system in sync with your billing platform automatically.

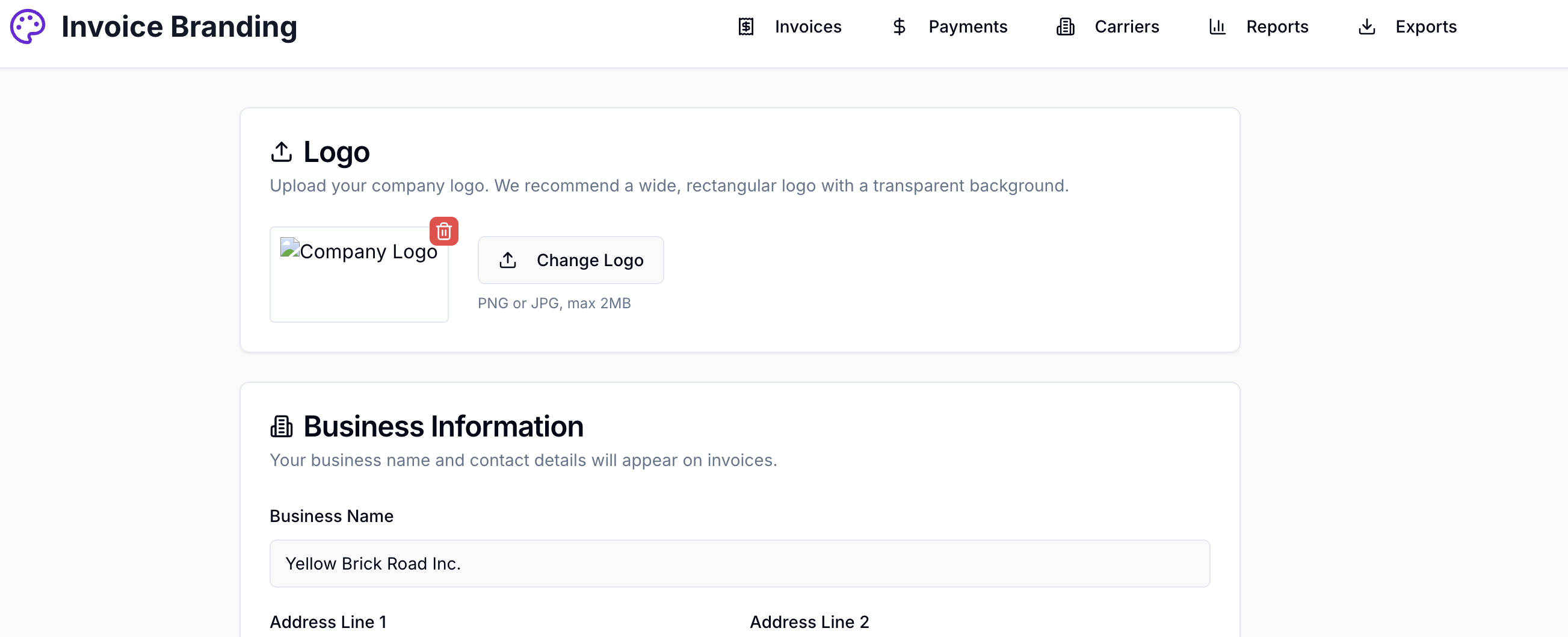

Invoice Branding

Make every invoice your own. Upload your logo, set your business details, and create professional-looking invoices that reinforce your brand with every customer interaction.

Built around how brokers & MGAs actually work

Policivo doesn’t ask you to change your business. It wraps around existing workflows and automates the painful parts, from invoice creation to carrier audits.

Broker invoicing & payments

Create invoices manually or import your existing spreadsheet. Collect ACH or card payments through a secure customer portal.

- 1. Enter invoice details manually or import via CSV.

- 2. Policivo generates clean, branded PDF invoices.

- 3. Customers pay online; dashboard updates automatically.

MGA remittance & carrier net

Handle MGA overrides and carrier net amounts from one place.

- 1. Define remittance rules for your programs.

- 2. Invoice and collect premiums with logic applied.

- 3. Auto-generate carrier and partner remittances.

Reconciliation & reporting

Stop chasing spreadsheets and missing dollars. Let Policivo match payments to invoices and flag discrepancies for you.

- 1. Payments and invoices sync in real time.

- 2. Carrier remittance dates and amounts auto-calculate.

- 3. Export reports for compliance and accounting in one click.

Works with your existing tools

Policivo fits into your current workflow. Import data easily and export to the systems you already use.

Simple, Usage-Based Pricing

All features included in every plan. Pay based on your billing volume.

Start with a 14-day free trial (250 billing events). No credit card required.

All Features Included

Every plan includes the full Policivo platform. No feature gating—just pay for the volume you use.

Compare Plans

Frequently Asked Questions

Everything you need to know about getting started with Policivo.

Built by an insurance finance veteran

Policivo is not a generic invoicing app. It was designed by someone who has lived the carrier, MGA, and broker billing pain for decades.

25+ years across AIG Private Client Group, PCS (MGA spin-off backed by Stone Point Capital), QBE P&C, Willis Towers Watson, and TriNet FP&A. I’ve led spin-offs, NetSuite implementations, MGA diligence, reinsurance structures, and built reporting, treasury, and close processes around exactly the problems Policivo solves.

Policivo is the billing platform I wanted at every insurance finance job I’ve ever had.